At Lund & Smith Insurance Services, we are committed to keeping you up-to-date on the latest crop insurance developments. The U.S. Department of Agriculture (USDA) has made significant changes to the Enhanced Coverage Option (ECO), starting with the 2025 crop year. These updates will provide expanded coverage options and increased premium support, making crop insurance even more accessible and affordable for farmers.

What is the Enhanced Coverage Option (ECO)?

ECO is an area-based insurance endorsement that supplements a producer’s underlying crop insurance policy. It provides additional coverage for a portion of the deductible, offering protection against both yield and revenue losses. Producers can choose between 90% or 95% trigger levels, which determine the percentage of expected yield or revenue at which a loss becomes payable.

Key Changes to ECO for the 2025 Crop Year

Expansion to New Crops

The USDA’s Risk Management Agency (RMA) has approved the expansion of ECO coverage to include several new crops, specifically almonds, apples, blueberries, grapes, and walnuts for the 2025 crop year. Additionally, for the 2026 crop year, citrus crops in California and Arizona, where the Supplemental Coverage Option (SCO) is currently available, will also have the option to be covered under ECO.

Increased Premium Support

To further support farmers, the RMA is increasing the premium support subsidy for all crops covered by ECO to 65%. This increase in subsidy funds aims to make the policy more affordable, allowing more producers to take advantage of the enhanced coverage offered by ECO.

Benefits of Enhanced Coverage Option (ECO)

- Comprehensive Coverage: ECO enhances a producer’s existing crop insurance policy by providing additional protection against both yield and revenue risks.

- Affordability: With the increase in premium support to 65%, ECO is now more accessible and affordable for a wider range of producers.

- Flexibility: ECO can be added as an endorsement to various types of crop insurance policies, including Yield Protection, Revenue Protection, Revenue Protection with Harvest Price Exclusion, and Actual Production History.

- Independent from FSA Programs: Participation in ECO is unaffected by enrollment in USDA’s Farm Service Agency’s (FSA) Agriculture Risk Coverage program, providing flexibility in coverage choices.

How Does ECO Work?

ECO provides coverage based on county-level yields and revenues rather than individual farm yields and revenues. This area-based approach offers an additional layer of protection by covering widespread losses that impact an entire region. Here’s how it integrates with existing crop insurance policies:

- Trigger Levels: Producers choose a trigger level of 90% or 95%. If the county yield or revenue falls below the chosen trigger level, ECO makes a payment.

- Coverage Calculation: The ECO coverage level is based on the difference between the chosen trigger level and the underlying policy coverage level. For instance, if you have a Revenue Protection policy at 80% coverage and select the 95% ECO trigger, ECO covers losses from 95% down to 86%.

Real-World Example of ECO:

Let’s say you grow corn with an expected value of $765 per acre (170 bushels at $4.50 per bushel). You choose a 75% Revenue Protection (RP) policy, which covers 75% of the crop value or $573.75 per acre, leaving 25% uncovered as a deductible.

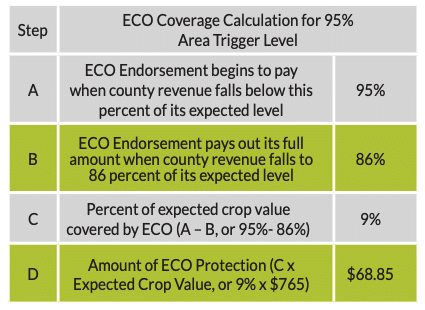

At this point, you have the option to buy ECO coverage. Since the underlying policy is Revenue Protection, ECO will also provide revenue protection, except that payments will be determined at a county level. The ECO revenue coverage is described in the following table. ECO yield coverage performs in the same manner.

The ECO Endorsement begins to pay when county average yield or revenue falls below 95 percent (or 90 percent, if that is the trigger level you elect) of its expected level. The full amount of the ECO coverage is paid out when the county average revenue falls to 86 percent, as shown on step B in the table. ECO payments are determined only by county average revenue or yield, and are not affected if you receive a payment from your underlying policy.

So it is possible for you to experience an individual loss but to not receive an ECO payment, or vice-versa. You may also receive a loss on both the underlying policy and ECO. The dollar amount of ECO coverage is based on the percent of crop value covered. In this example, there are 9 percentage points of coverage – from 95 percent to 86 percent. Nine percent of the expected crop value is $68.85 (or 9 percent times $765.00). Thus, the ECO policy can cover up to $68.85 of the $191.25 deductible amount not covered by your underlying policy. You may cover a portion of the remaining amount of the deductible with other coverage such as the Supplemental Coverage Option (SCO). Now consider an event wherein the actual county revenue falls to 89% of the expected value. This loss is 6 percentage points less than the trigger level elected (95% – 89% = 6%). This indicates a loss of 66.67% of the ECO coverage range (6% / 9% = 66.67%). This loss is then applied to the amount of ECO protection to determine an indemnity of $45.90/ac (66.67% x $68.85 = $45.90).

Conclusion: How ECO Enhances Your Crop Insurance Strategy

At Lund & Smith Insurance Services, we know that protecting your farm is more than just a necessity—it’s peace of mind. The USDA’s enhancements to the 2025 Enhanced Coverage Option (ECO) offer farmers a more robust, affordable way to manage their risk. With expanded crop eligibility and increased premium support, ECO provides an excellent opportunity to strengthen your crop insurance coverage.

Contact us today to discuss how ECO can be integrated into your crop insurance strategy for the 2025 season and beyond. We’re here to help you navigate these changes and ensure your farm is fully protected.

Visit the USDA’s Risk Management Agency website to learn more.

Stay protected, stay informed.

Review Your Coverage Options?

Intersted in learning more about Crop Insurance or want to make a switch?